Homeowners Insurance in and around Richardson

Richardson, make sure your house has a strong foundation with coverage from State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

Your house isn't a home unless you enjoy coverage from State Farm. This fantastic, secure homeowners insurance will help you protect what you value most.

Richardson, make sure your house has a strong foundation with coverage from State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Homeowners Insurance You Can Trust

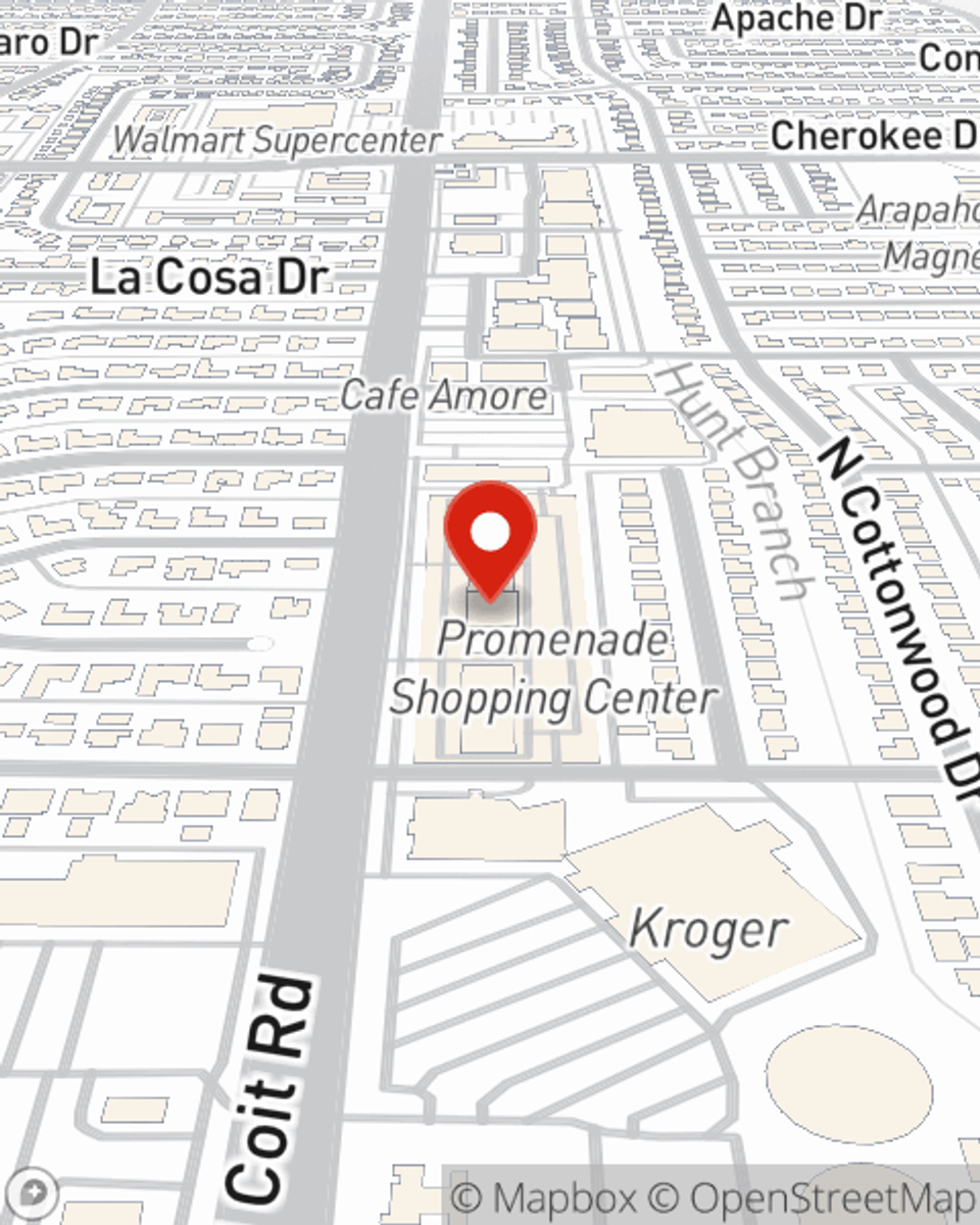

Are you looking for a policy that can help cover both your home and your possessions? State Farm agent Mike Hart's team is happy to help you create a policy that's right for your needs.

Terrific homeowners insurance is not hard to come by at State Farm. Before the accidental takes place, reach out to agent Mike Hart's office to help you put together the right home policy for you.

Have More Questions About Homeowners Insurance?

Call Mike at (972) 234-4513 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Simple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.